Limited Liability Partnership in short we can say LLP is a Hybrid structure. Hybrid of a Company and a Partnership Firm. It is a unique corporate structure that has certain features of limited liability of the company and the flexibility of a Partnership Firm.

Changes of partners and the un-authorized actions of partners will not affect the existence or the continuity of LLP. LLP is totally a separate legal entity since entering into contracts and holding property in its own name. Each right and duties of the partners in an LLP are governed by a mutual agreement between the partners or between the partners and the Limited Liability Partnership. LLP agreement is a fundamental part of the whole entity. It defines the terms, responsibilities, shares, conditions of the relationships, etc. Every function in a Limited Liability Partnership is based on that agreement. So the partners cannot lead any wrongful business decisions or misconduct. Based on the mutual agreements one partner is not responsible for the other partner’s malpractice.

Also, LLP is liable to the full extent of its assets but the partner’s liability is limited to their contribution.

If you are applying for an LLP Registration, then you should be aware of the types of partners. In a Limited Liability Partnership, there are two types of partners, designated partner and managing partners. Partners who are managing the whole business are called managing partners. Partners those who are dealing with Compliances of LLP Act, Income tax, etc are known as Designated partners. Sometimes, the designated partners can act as managing partner. But it is not true for all the cases.

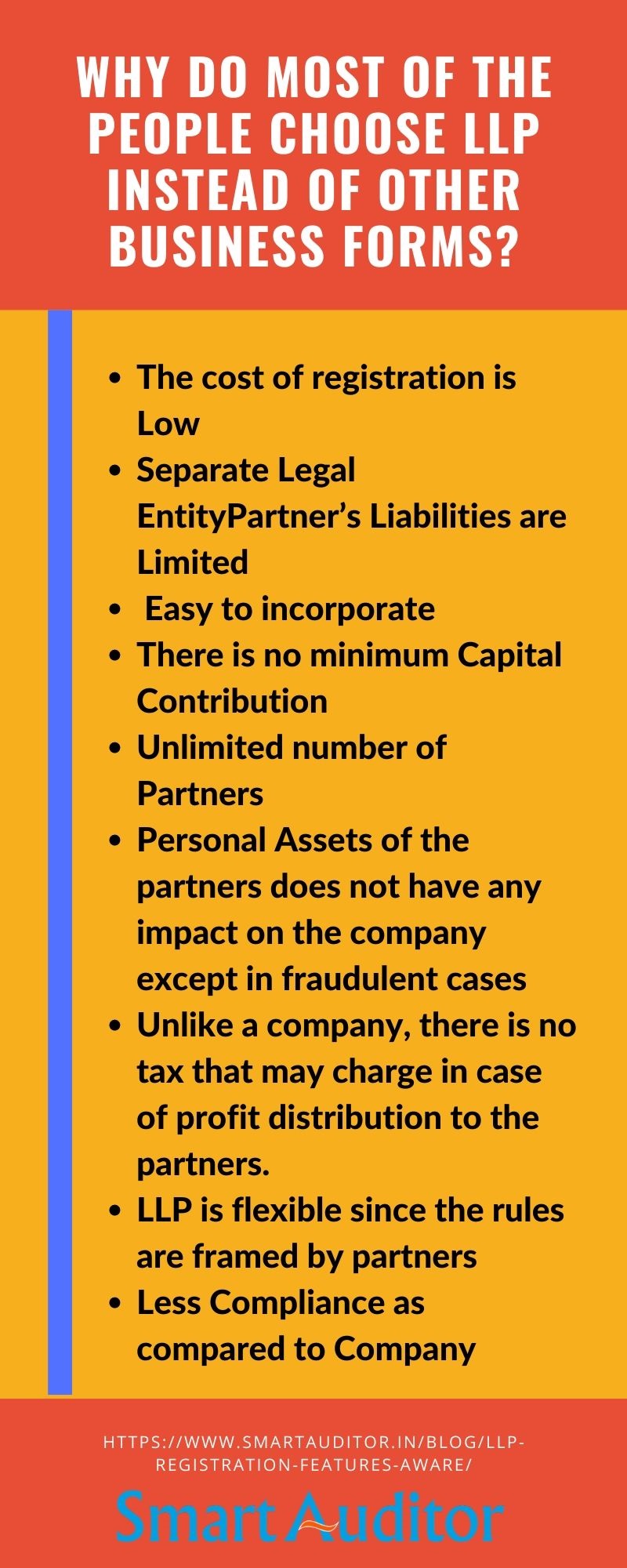

Why do most of the people choose LLP instead of other business forms?

The greatest advantage which attracts more people is LLP’s Flexibility. LLP offers flexibility to process the business. There are no complex legal provisions and it is free to process and manage. Also, these advantages are not available in any other business forms. So, most of the companies have started to convert or incorporate their business in a Limited Liability Partnership. Here are some key points of Why do most of the people choose LLP Registration instead of other business forms.

- The cost of registration is Low.

- Separate Legal Entity

- Partner’s Liabilities are Limited

- Easy to incorporate

- There is no minimum Capital Contribution

- Unlimited number of Partners

- Personal Assets of the partners does not have any impact on the company except in fraudulent cases

- Unlike a company, there is no tax that may charge in case of profit distribution to the partners.

- LLP is flexible since the rules are framed by partners

- Less Compliance as compared to Company

Which are the firms where LLP is Suitable for?

- Small to medium scale businesses

- Most of the service based industries

- A business where multiple partners and they have multiple roles

- Businesses are driven by owners but have investors who play as a silent partner role.

- Start-ups

What are the minimum requirements to form a Limited Liability Partnership?

- There should be a minimum of two partners

- There should be a minimum of two designated partners among the total partners of Limited Liability Partnership

- Registered Office Address should be in India

- At Least 1 partner should be an Indian Resident

- You can incorporate Limited Liability Partnership only for Profit-making

What are the processes in LLP Registration?

- Deciding Partners

The very first step of LLP Registration is deciding the partners. Individuals who are resident in or outside India, LLP Registered in or outside India and the companies or body corporate which are registered in or outside India can apply as a partner in LLP.

- Obtaining Digital Signatures of Designated Partners

A digital signature is a mandatory thing for all Legal Services. It is an electronic fingerprint. It reduces the processing time and allows the company registration to be done without the physical presence of the director.

- Applying for DIN of Designated Partners

DIN or Director Identification Number is a unique 8 digit code. Every existing or proposed director should acquire that DIN. At first, Din was introduced in the Companies Amendment Act, 2006.

- Checking Name Availability of LLP

After getting DSC and DIN we have to check the name availability of LLP. Name availability can be checked on the MCA Website. This is mainly to avoid further legal problems based on similarity in the company name. If any other company registered in the same name we cannot apply for the same name. If we should have done so it results in objection and further denial of the name.

- Applying for Name Approval

If the name is available, then we can apply for approval. This guarantees 100% approval since the name is not registered as any other company name.

- Preparing & Filing Incorporation documents

For Incorporation, We need the following documents with self-attested

- All partners latest Passport Size Photo

- PAN (Permanent Account Number ) of minimum 2 partners

- Each Partner’s Identity Proof (Aadhar Card, Passport, Driving License or Voter ID Card)

- Each partner’s Present address Proof (Bank Statement or Passbook Copy, Electricity Bill, telephone bill, or any utility bill)

- Registered Office Address Proof (Electricity Bill, Rental agreement or the ownership proof of registered office)

- Stamp paper for LLP Agreement of State where LLP is to be registered.

7) Generating LLP Incorporation Certificate

If every mentioned process gets over and there is no objection, the next step is generating the certificate of LLP Incorporation.

8) Preparation & Filing of LLP Agreement

The last step involves the preparation & filing of the LLP Agreement. This agreement is the overall functioning of LLP and partners or between partners. After generating the agreement you can confidently run your Business.

Conclusion

LLP is the most suitable form for most of the business. As we mentioned above Limited Liability Partnership has certain features that make the entity unique among other business forms. We Smartauditor Provide LLP Registration in Salem, Trichy, and Erode. At the beginning of each registration service, we are providing Business consultation that you can get free of cost.

That consultation helped lots of people to clarify which business form is suitable for their business. Our Services include Company Registration, Trademark registration, Patent registration, Copyright registration, and GST registration & filing. We have experienced company registration secretaries and IPR attorneys to solve out all your hindrances. ṣ

Forget about your worries, we are here to serve an outstanding service for you!!

Thank You!!