GST is Goods and Services Tax. To bring the whole nation into unified market GST is implemented. Likewise, GST Registration also implemented as a continuous rule implementation. Goods and Services Tax is paid by the customer, but it is remitted to the Government by selling the goods and services which is done as a business. Added to it GST provides revenue for the government. The types of Goods and Services Tax are SGST (State GST), CGST (Central Goods and Services Tax ), IGST (Integrated GST), and UTGST (Union Territory GST).

Seven months after formation of the central government, the new Finance Minister introduced the GST Bill in the Lok Sabha. So we have to understand that the business people add the GST and the consumer who buys the things or consume food has to pay the price and GST. Before the implementation of Goods and Services Tax there were 23 types of tax prevailing. But now it is enough to pay only GST as single tax. There are 40 models in Goods and Services Tax and 120 countries follow GST. In India dual model is followed. So both and centre and state make use of it. It is a game changer in Indian economy.

Importance of GST

We know that before implementation of GST Registration there were 23 types of taxes and they were imposed directly or indirectly. Direct tax means we directly pay tax as we get income. Indirect tax means the manufacture and delivery will include tax and we have to pay for it when we consume it. For things like fruits, vegetables, milk, LPG, cooking oil, mineral water, soda, toothpaste, soap and smart phone Goods and Services Tax will be reduced. Tea, TV, AC, Fridge, Chocolate and beauty products will have increased GST.

The cascading effect of tax is reduced because of Goods and Services Tax Registration . It can be explained as, when I manufacture a product, I give tax for 10% and I sell for the retailer. The retailer gives the value as Rs.12, and then you have to pay tax for the rs.12 also. So it is like paying tax over the tax. But in GST, you have to pay the tax only for the value added. So important aspect of Goods and Services Tax is reducing the cascading effect.

GST Calculations

There are slabs which say what are all the products should be given what types of GST. In GST Registration if you 28% of tax means it will be divided as 14% + 14%. If you are running a business and if the profit is above one crore every month you should pay Goods and Services Tax . If the profit is below one crore you have to pay it once in every three months.

There is still no clear about Goods and Services Tax . Three groups were formed, one is to form legislative Act, other one is to form process and form and the third one is to form the Information Technology. It is destination based tax. Whoever consumes it, will have to pay the tax and the state will take benefit of it.

Where it is applicable

GST Registration is applicable at point of sale. GST is applicable not only in India, but also internationally which is based upon the destination. Also it is applicable within the states of India; we call it as interstate or intrastate. Also ecommerce traders must register and state wise registration is also done. For goods that have continuous supply, on or before date of issue of account statement or payment Goods and Services Tax should be paid. For the services of general cases within 30 days of supply of services GST should be paid. For services of bank and NBFcs within 45 days of supply of services Goods and Services Tax should be paid GST should be paid.

E-commerce operator, agent, service distributors are applicable for GST Registration . Also if the threshold is above 20 lakhs, such registered taxable people should pay Goods and Service Tax. For hill stations it is about Rs.10 lakhs.

TDS

TDS is tax deducted at source. It is a mechanism to track transaction of supply of goods and service by making the recipient of supply. The collected tax is revenue to the Government. Department of Central or State Government, an establishment or agencies, local authority and such category of persons as may be notified by Central or State Governments on the recommendation of GST Registration Council. Recipients of goods and services are also called as deductors.

What is Goods and Services Tax registration?

Registered taxable person is allotted in each state or UT having business PAN, PAN based fifteen digits Goods and Services Tax Identification Number (GSTIN). An unregistered vendor cannot charge Goods and Services Tax on invoice. And also a person without GST registration can neither collect. He should be recognised legally. Goods and Services Tax from his neither customer nor claim any input tax credit of GST paid by him.

What is GST filing?

Goods and Services Tax filing means it is return form which is filled by the authorities of the income tax. With tax identity one can do GST filing. The Network of Goods and Service Tax will store information of all sellers and buyers who are GST registered, combine the submitted details, and maintain registers for future reference. Companies have to file three monthly returns every three months and one annual return in a financial year. Taxpayers can use the template to collate invoice data on a regular basis. The data preparation can be done offline. There are no manual entries and auto filing of return on Goods and Services Tax portal is done.

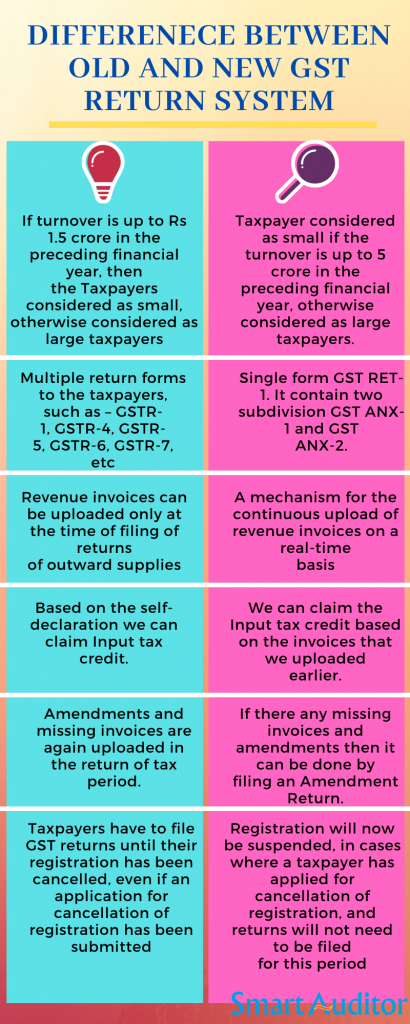

What is GST return?

Goods and Services Tax return is a document that will contain all the details of your sales, purchases, tax collected on sales (output tax), and (input tax ) which is the tax paid on purchases. There are 4 types of GST return GSTR1, GSTR2, GSTR3 and annual return GSTR9.

Documents required for Goods and Services Tax registration

The documents required for GST registration for individual are:

PAN card, Aadhar card, Bank account details, address proof of the office. If it is own office means copy of electricity bill, rented means, NOC from the owner.

The documents required for LLP are: PAN card, Aadhar card, Bank account details, address proof and registration certificate of LLP.

In case of private ltd/public limited or OPC the documents required are PAN card, Aadhar card, Bank account details, and address proof of the office. If it is own office means copy of electricity bill, rented means, NOC from the owner and Memorandum of Association (MOA), Article of Association (AOA). For HUF (Hindu Undivided Family) Photos of Karta, address proof (Electricity bill, rent agreement), bank account details, and authorisation letter from Karta. For Trust/ society, proof of constitution of business, PAN and photo of the promotor, Photo of authorised signatory, letter of authorisation and copy of resolution passed by managing committee.

Procedure

The procedure for GST registration follows. For new registrar, get into the GST online portal, select the field whether you are a new taxpayer, or Tax Deductor , non- resident taxable person whatever the option is available you may select. Then select state, district, legal name of the business, PAN. Also select email address and mobile number. An OTP is sent, and Captcha is entered. You will get temporary reference number. With this temporary reference number, you may select the registration in Services tab and you may proceed. Various fields like business details, promoters/partners, Authorised signatory, Principal place of Business, additional places of Business, goods and services, bank accounts, state specific information fields are given finally verification is done. Finally you will receive success message.

Conclusion

It is a multistage, comparative and destination-based tax: comprehensive almost all the indirect taxes because it has subsumed. Multi-staged as it is, the Goods and Services Tax is imposed at every step in the production process, goods and service provider. If you fail to register GST, you will have heavy fines and penalties. So in order to avoid conflict you need to register GST for sure. The efficiency of logistics is improved. Due to Goods and Services Tax implementation, corruption is reduced and the aim is to bring forth the black money from the people.

We Smartauditor offers GST registration in Trichy, Erode and Salem at affordable cost and less time delay. Our services include all types of Company Registration, Trademark Registration, Patent Registration, Copyright Registration, and other Services. Do you want to Get more services then connect with our customer executives. They will help you to get the best experience.